(Reuters) -Eli Lilly hit $1 trillion in market value on Friday, making it the first drugmaker to enter the exclusive club dominated by tech giants and underscoring its rise as a weight-loss powerhouse.

Here are some reactions to Lilly joining the trillion dollar club:

EVAN SEIGERMAN, ANALYST AT BMO CAPITAL MARKETS

"The current valuation points to investor confidence in the longer-term durability of the company's metabolic health franchise. It also suggests that investors prefer Lilly over Novo in the obesity arms race. Taking a step back, we're also seeing money rotate into the sector as investors may be worried about an AI bubble."

HANK SMITH, DIRECTOR & HEAD OF INVESTMENT STRATEGY AT LILLY SHAREHOLDER HAVERFORD TRUST

"Investors have historically liked secure earnings growth and (Eli Lilly) is the only large cap pharma that has that kind of earnings profile."

(Reporting by Siddhi Mahatole and Shashwat Chauhan in Bengaluru; Editing by Leroy Leo)

Instructions to Pick the Best Album Rates for Your Investment funds

Instructions to Pick the Best Album Rates for Your Investment funds 6 Exercises to Anticipate in 2024

6 Exercises to Anticipate in 2024 'Israel has the right to continue its attacks,' Lebanese Foreign Minister announces

'Israel has the right to continue its attacks,' Lebanese Foreign Minister announces Conquering Social Generalizations: Individual Accounts of Strengthening

Conquering Social Generalizations: Individual Accounts of Strengthening A Time of Careful Eating: Individual Tests in Nourishment

A Time of Careful Eating: Individual Tests in Nourishment How much should a kid's birthday party cost? One mom spent $190 for pizza and ice cream at a park. Another paid $2K for a playspace and goodie bags.

How much should a kid's birthday party cost? One mom spent $190 for pizza and ice cream at a park. Another paid $2K for a playspace and goodie bags. How will the universe end?

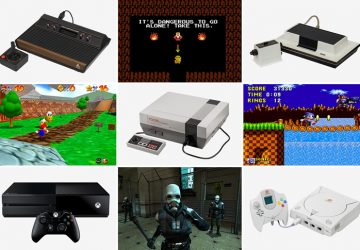

How will the universe end? The Main 20 Gaming Control center Ever

The Main 20 Gaming Control center Ever Vote in favor of your Favored sort of footwear

Vote in favor of your Favored sort of footwear